53% of Americans Don’t Have Emergency Savings

At The LevelUp, part of our goal is to empower financial wellness while still being a fun part of your day. But given the importance of personal finance, sometimes we have to broach a topic without leaving room for humor.

Emergency savings accounts are a prime example- specifically their growing lack of popularity.

Most Americans don’t have an emergency savings account

If you ask us, you can’t have financial security without an emergency savings account.

Think of it like any other type of insurance; it’s not the most exciting thing in the world, but it could save you an enormous headache down the road.

If you’re part of the 53%, here’s 3 things you can do to start saving today.

1.) A little budgeting

There’s no guarantee how long you’ll need your emergency funds to last, but a good rule of thumb is about 5 months.

Once you know your necessary monthly expenses- mortgage/rent, childcare, car payments, etc. – just multiply by 5 months to get a target figure for your account.

2.) Open a money account

There’s no reason this step should take significantly longer than the first one (if it does, we recommend updating your WiFi).

Here are a few popular accounts right now:

- SoFi savings: 4% savings accounts

- Magnifi Cash: 5% high-yield savings account with a Magnifi subscription

- Discover Bank Online Savings Account: 3.75% savings account

- Prime Alliance Personal Money Market Account: 4.05% variable rate money market account

For more information on some of the above money accounts, check out our article on beating inflation.

3.) Increase returns with diversification

Starting an emergency savings account doesn’t mean you have to be limited to one savings option. In fact, a diversified emergency fund is a great way to increase returns while maintaining a safe- immediately accessible- foundation.

Here are our top picks for accelerating those returns.

- TD Ameritrade Account

- 2 year Treasury Bond

- Goldman Sachs 10-month CD

Ready to start?

We hope these steps have put you on the path to your own emergency savings plan.

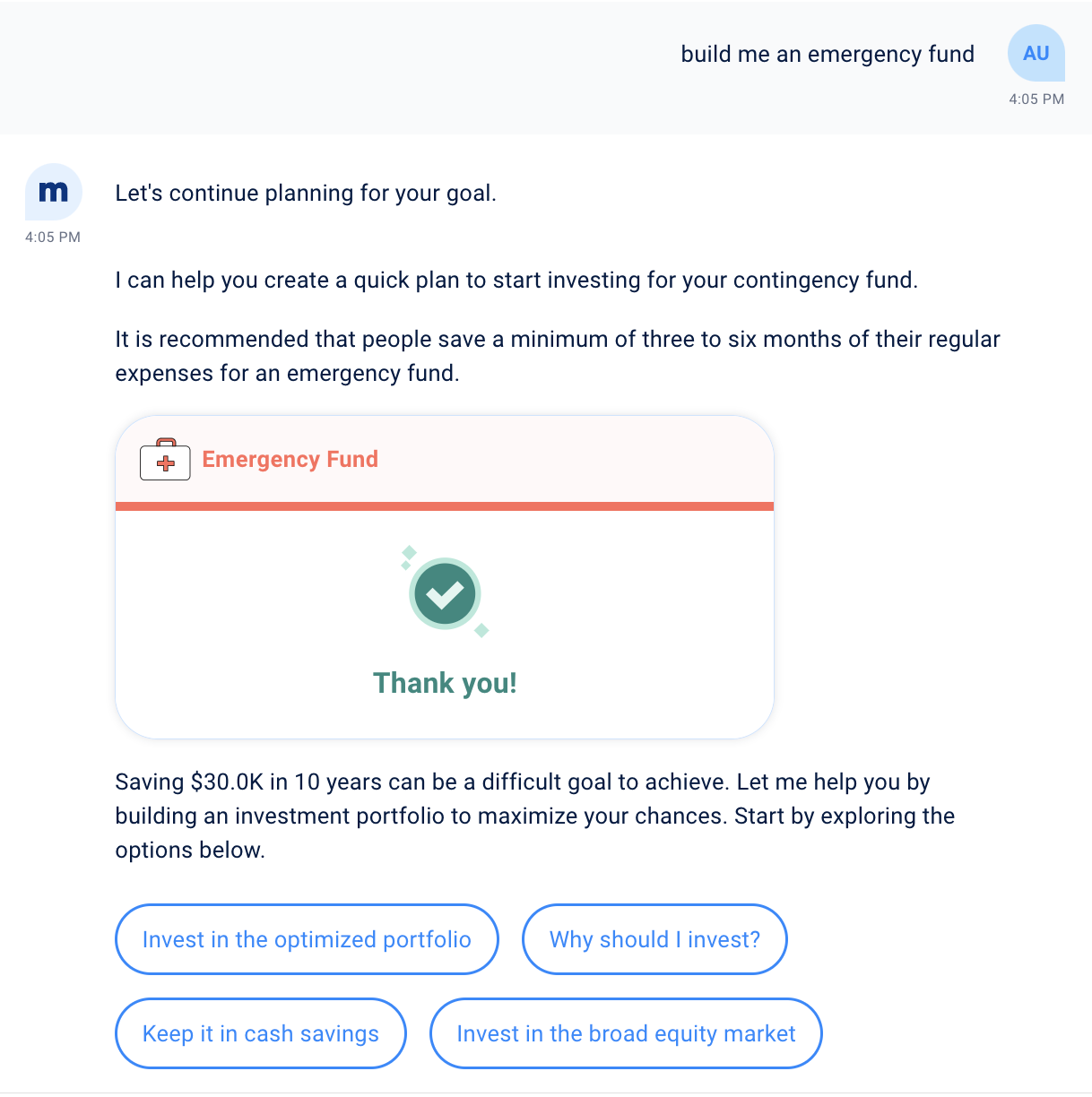

If you’d like more insights on your own plan, including how to increase returns over time, check out Magnifi’s emergency fund builder.

Just ask Magnifi, “make me an emergency savings plan” and input the information for your current plan.